Under this fact pattern Entity B would need to update its registration for the name change but would not need a new GIIN. The term disregarded entity refers to how a single-member limited liability company LLC may be taxed by the Internal Revenue Service IRS.

Separate Legal Entity Ipleaders

If youre wondering whether to use your personal name or a DBA creating a DBA allows you to promote your business without compromising your privacy.

. However the employing body may nevertheless wish to obtain separate legal advice in some cases Inquests and inquiries. Person buys a 50 percent interest in the entity from A. A Colorado LLC operating agreement allows the partners members of a company to enter its rules and ownership interest.

Entity definition something that has a real existence. These include corporations cooperatives. If the business is a separate entity that shield or veil cant be pierced.

A business entity is an entity that is formed and administered as per corporate law in order to engage in business activities charitable work or other activities allowable. UpCounsel accepts only the top 5 percent of lawyers to its site. Updated June 07 2022.

Tax entity examples include C Corporations S Corporations and sole proprietorships. If your LLC is deemed a disregarded entity it simply means that in the eyes of the IRS your LLC is not taxed as an entity separate from you the owner. A corporation is not allowed to hold public office or vote but it does pay income taxes.

Legal entities have a choice about what tax entity they want to identify as. Determining Disregarded Entity Status. Most often business entities are formed to sell a product or a service.

This concept applies in several situations including. Corporate Commonwealth entity means a corporate Commonwealth entity within the meaning of paragraph 11a of the Public Governance. There are many types of business entities defined in the legal systems of various countries.

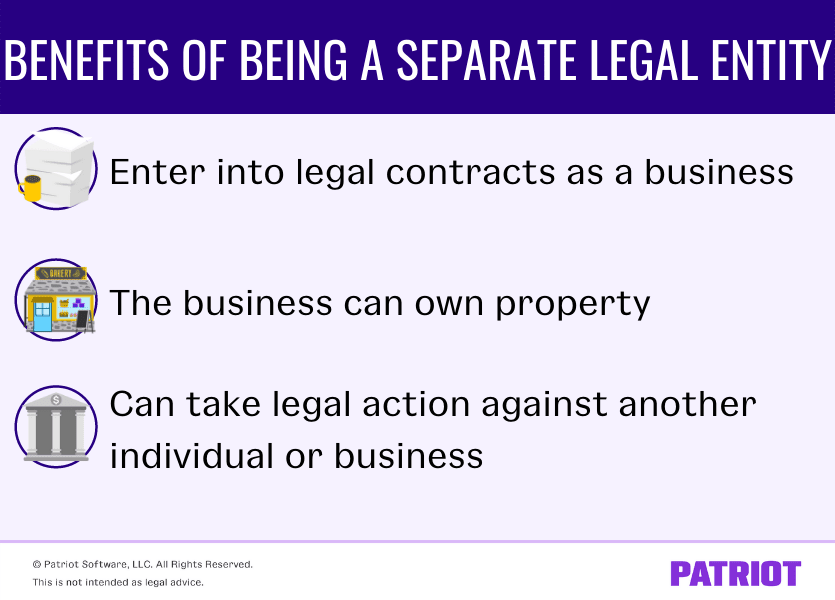

The addition of the words agency agent. The concept of the separate entity can be found in the term corporate shield or corporate veil meaning that the corporation or other separate entity is shielded from liability. Noun the existence of a thing as contrasted with its attributes.

If you need help with Ambr Meaning LLC you can post your legal need on UpCounsels marketplace. Keep your private life separate. The words insurance reinsurance assurance and surety in a proposed name for a business entity that is not subject to the Insurance Code as an insurer may mislead the public unless the words are accompanied by other words that remove the implication that the business entitys purpose is to be an insurer.

Both an LLC and a corporation can file an S Corp election and choose to be taxed as an S Corporation even though they are. However an association formed not for profit also acquires a corporate character and falls within the meaning of a company by reason of a license issued under Section 81 of the Act. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience including work with or on behalf of companies like Google Menlo Ventures.

A corporation is treated as a person with most of the rights and obligations of a real person. B acquires A and A wishes to become a member entity. 16 Expenditure may be approved for an employee to be legally represented in connection with an.

Such items include management manager or member-managed capital contributions fiduciary duties officer. Existing or happening independently or in a different physical space. A corporation is a legal entity meaning it is a separate entity from its owners who are called stockholders.

However A and B elect to have the entity classified as an association effective on. One that has no weight worth or influence. If Entity A had previously registered for FATCA it would need to terminate its registration.

If that is the case the database provider should secure separate permission from the other authors before publishing the database under a CC legal tool. It may be established as a profit making or nonprofit organization and may be publicly or. Any binding language that the members agree upon can be included in an operating agreement.

In common law a company is a legal person or legal entity separate from and capable of surviving beyond the lives of its members. Under this paragraph f the entity is classified as a partnership when B acquires an interest in the entity. You limit using your personal name in day-to-day business transactions.

It is responsible for administering all of the Cayman Islands legal frameworks for international cooperation in tax matters and for carrying out the functions of the Tax Information Authority the Cayman Islands competent authority. Person owns a domestic eligible entity that is disregarded as an entity separate from its owner. Most individuals want to keep their business identity and personal life separate.

If a database maker decides to license the database without securing permission from the authors of the database contents it should clearly indicate the material for which permission has not been secured and. On January 1 1998 B a US. There are different ways for Entity A to become a member of Entity B.

To cause to divide. Subsequently this reflects how your business will be taxed.

The Concept Of The Separate Legal Personality Of A Company

What Is A Separate Legal Entity Definitions Examples More

0 Comments